As a value investor in the corporate credit market, we are frequently asked, “in this low default environment, what are you working on?” Fortunately, I came across an article today, that clearly shows what we are working on. Just goes to show you that default statistics are very misleading in the corporate credit market. The article by FTI Consulting appropriately titled “Beware of the killer B’s”. [Link to Article]

- There are 2,000 rated US issuers in the BB+ and lower category

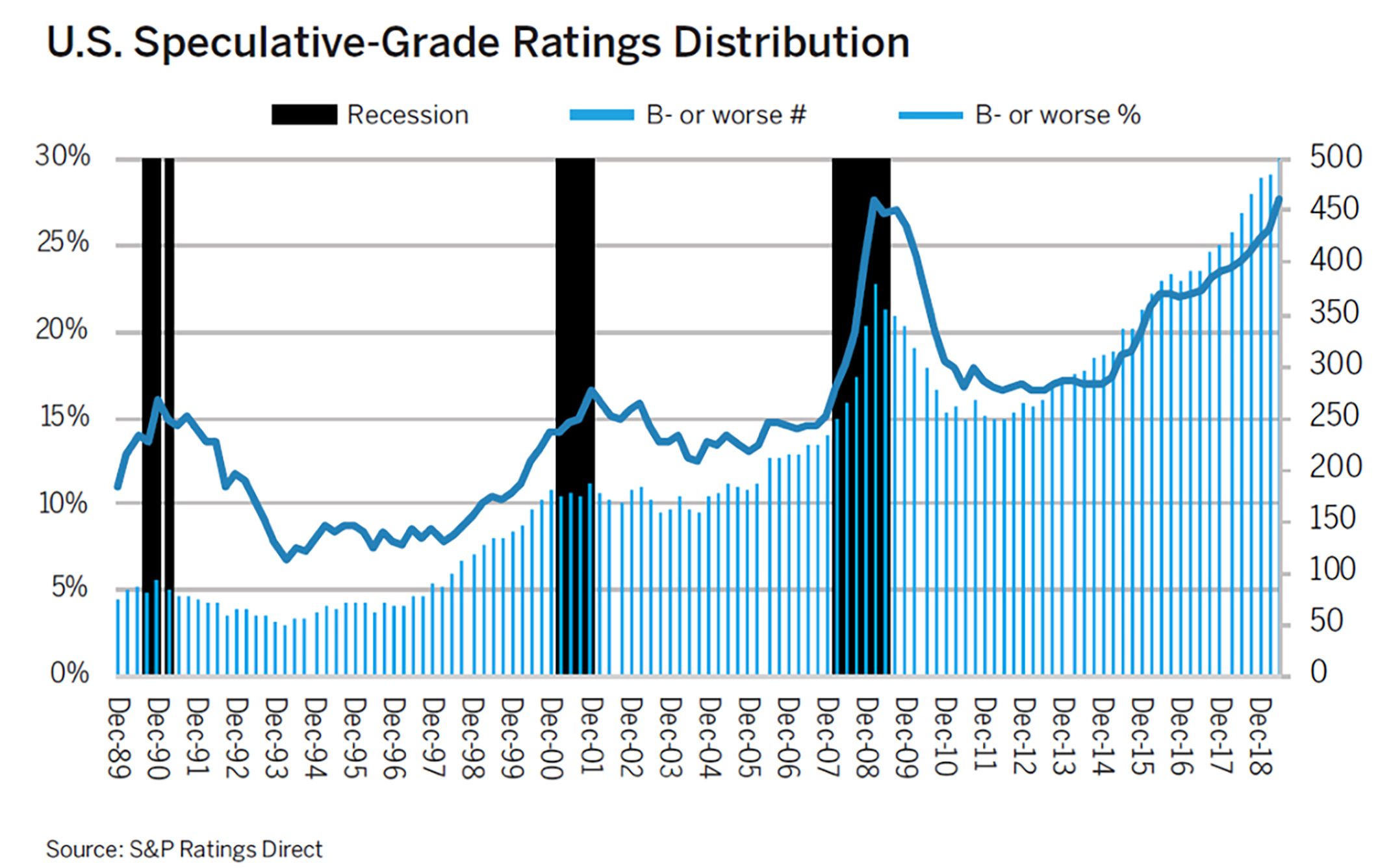

- Appx 28% of these are rated B- or worse

- That’s equals about 500 issuers, double since 2013.

- Despite the 1 notch difference, a B- is more than twice as likely to default than a B (flat).

- One-year 7.7% vs 3.6%

- Three-year 21.3% vs 12.6%

- For BB’s, its almost equally likely that an issuer will be upgraded or downgraded one or two notches within a year

- For B+ and B (flat) the likelihood of a downgrade of one or two notches, slightly exceeds that of a possible upgrade

- For the B-, the change of a downgrade one or two notches is 2X to the upgrade

- Far more B- issuers don’t make it back up from the slippery slope

- Based on these stats, we are looking at about 95 defaults in 2020 vs 2019’s 78.

- Throw a little economic fuel on the fire? There will be plenty of opportunities to invest in.

- Keep this in mind, not all of these B-’s will default, but you can rest assured that there will be an opportunity to buy them on the cheap, and earn a nice return; distressed (value) does not always equal default.